Two Hedge Funds That Nailed The MuleSoft Trade

Posted on March 26th, 2018

MuleSoft Inc. (MULE) isn’t a name we all come across often, but the week-ended March 23 saw Salesforce.com Inc. (CRM) announce it would acquire the software company for nearly $6.5 billion, a huge buyout for a company that had a market value of approximately $4 billion on March 1. But some investors were loading up on shares of the stock during the fourth quarter. The stock was also added to the WhaleWisdom Whale Index 100 on February 15, after evaluating all the recent fourth quarter filings.

The stock was having a momentous year and had already been up by 48.5 percent through March 16. However, after the announcement of the deal, the stock nearly doubled and is now up 89 percent in 2018.

Big Buying Activity

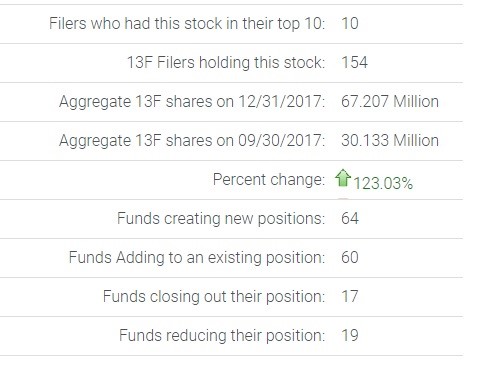

According to data on WhaleWisdom’s website, 64 funds created new positions in the stock during the fourth quarter, while 60 funds adds to their current holdings. However, surprisingly, only 17 funds closed out their position, while 19 lowered their stakes.

2 Funds Make A Huge Bet

A couple of funds made big bets on the stock during the fourth-quarter such as Sylebra HK Company Ltd, based in Hong Kong. Which acquired nearly 4.6 million shares, a market value at the time of $106.7 million, giving them a 6.1 percent stake in the company.

Palo Alto-based Meritech Capital Associates IV, LLC was another aggressive buyer of the stock during the fourth-quarter. The fund bought approximately 3.1 million shares of the stock for a market value of $72.3 million, making it 42.6 percent the funds total portfolio, a concentrated bet.

All About Growth

There were plenty of other funds making big bets in the stock, but for these two funds, it paid off in a big way. Analysts are looking for this company to see huge growth over the next few years, with revenue expected to climb to $713.50 million in the year 2020, from just $296 million in 2017, according to data on Ycharts.

Investors were clearly betting on MuleSofts long-term growth opportunities in cloud computing, and its Anypoint Platform for API connectivity. A platform that Salesforce sees as a way to add another layer of growth to their rapidly growing business.

It is not always the case that tracking investors buy and selling activity of stocks works out so well. However, in this case, watching the big bets by the two funds and the overall heavily bullish sentiment of other funds during the quarter paid off in an enormous way.