Investors See Cognizant Rising, While Analysts Have Their Doubts

Posted on March 20th, 2018

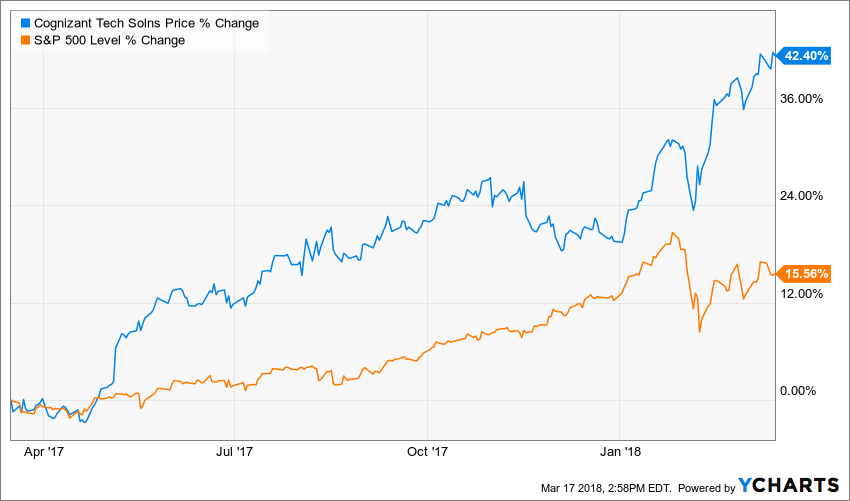

Cognizant Technology Solutions Corp, (CTSH) shares have surged by nearly 42.5 percent over the past 52-weeks, and by over 18 percent in 2018. According to 13F filings on WhaleWisdom, investors were adding shares of the stock to their portfolio during the fourth quarter, while also being added to the WhaleWisdom WhaleIndex 100 on February 15.

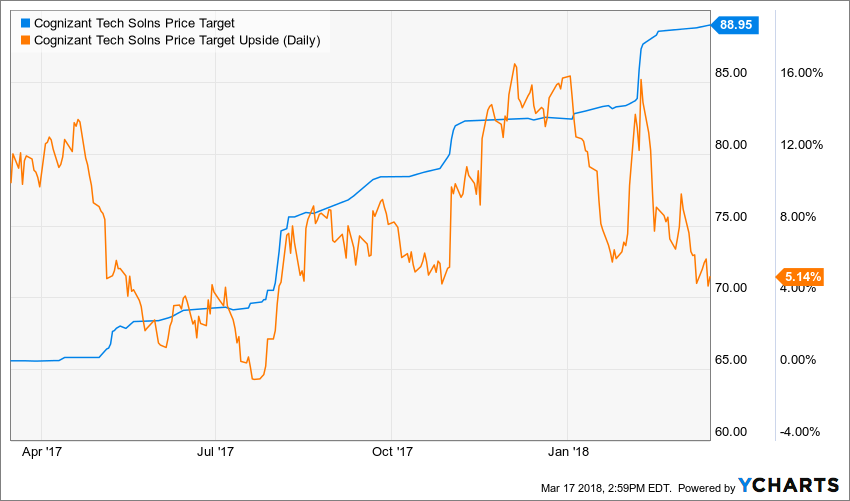

The bullish investor optimism comes despite a muted outlook from sell-side analyst, which see the stock rising to only $88.75 on average according to data from Ycharts. It could be an indication there is not much more room for shares of Cognizant to increase, or that analysts are underestimating Cognizant’s business and will need to up those estimates and targets.

A Large Number Of Funds Enter

According to WhaleWisdom, 150 funds started new positions in the stock during the fourth quarter, while 361 bought more shares. Only 57 managers closed out their holdings, while 345 reduced the number of shares held. The aggregate 13F shares as of December 31, 2017, increased by 2.12 percent to 517.588 million.

Concentrated Bets

Ten funds made big bets shares would continue to rise in 2018, with Cognizant representing 7.5 percent or more of the funds’ total holdings. During the quarter Winslow Capital Management initiated a 3 million share position in the stock, a market value of $217.5 million, while Arrowstreet Capital added 4.4 million shares, a market value of $314 million. Both represent significant increases by market value during the quarter.

Analysts Not as Optimistic

However, Analysts do not seem as bullish on the stock, with the average price target of $88.75, roughly 5 percent above the current stock price of approximately $84.60. It could be because analysts are forecasting growth at Cognizant to slow substantially over the coming years. Analysts are only predicting sales growth of 8.8 percent in 2019 to $17.6 billion, while earnings are expected to climb by 13.1 percent to $5.15 per share. While the stock currently looks cheap, adjusted for growth shares gets expensive.

Not Cheap Currently

With the stock currently trading at 16.5 times 2019 earnings estimates, with a growth rate of 13.1 percent, the 2019 PEG ratio climbs to 1.25, making shares not all that cheap. However, it also demonstrates why investors were likely buying up shares of Cognizant in the fourth quarter, because they saw shares as being cheap at the time. The big gains since the start of 2018, have likely made the stock a winning investment for most funds.

However, the shares are already up quite a bit in 2018, and it will be interesting to see if the investors adding in the fourth quarter stick around beyond the first quarter or if they will dump their shares and take their profits.