Roku Faces More Selling Pressure From Insiders

Posted on April 2nd, 2018

Roku had been among the hottest in the stock market in 2017, with the stock climbing by 120 percent. However, 2018 has been a different story with the stock falling by nearly 40 percent. The outlook may not get better in the near-term either because according to data collected by WhaleWisdom, insiders have been dumping the stock since the expiration of the initial public offering (IPO) lock-up.

Roku, the maker of a stream media player, came public on September 27, 2017, at a price of $14. The lock-up period for insiders, owners of the stock before the IPO, could not sell their holdings for 180 days. It means insider first became eligible to sell shares at the end of March.

Insider Sales

According to the prospectus, a hand full of venture funds held shares of Roku before the stock came public, acquired through private placements. However, through recent form 4 filings, it appears these funds are now beginning to distribute their shares to the general and limited partners.

Globespan Capital Partners V LP owned about 5.226 million shares of Roku and from March 27 through March 29, have sold nearly 1.6 million of those shares in a price range between $31 and $33.50. The shares sold to this point by this fund represent about 11 percent of Roku’s total volume over those three trading days of 14.1 million share.

Menlo Ventures owns about 24.2 million shares of Roku, and while form 4’s do not show that they started selling shares yet, it shows they have converted their stock from class A to Class B common shares, and have distributed 4.3 million of the total shares to their general partners.

Institutions Avoid Roku

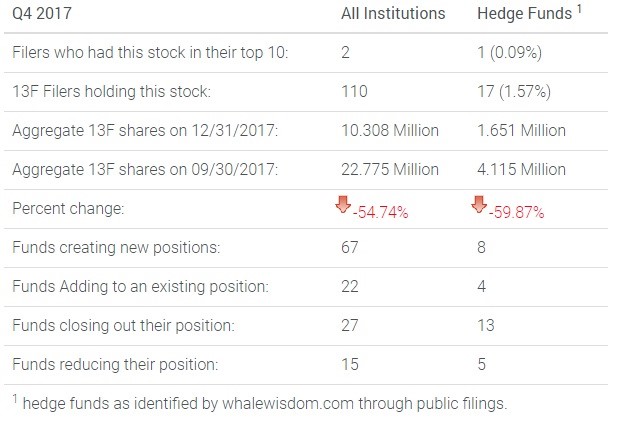

It would also seem that not many hedge funds or institutions were buying shares of Roku during the fourth quarter as the stock was climbing. In fact, when reviewing the data, it appears they have been selling their shares. During the quarter 67 funds created new positions and 22 added to existing positions, while 27 closed out their positions and 15 reduced the stake. However, the number of aggregate 13F shares on December 31 was only 10.3 million, down nearly 55 percent from 22.77 million on September 30.

Short Selling Surges

Roku’s short interest has been steadily climbing as well, and sits at near record levels for the stock, with nearly 9.26 million shares short. It represents nearly 59 percent of the Roku’s total float. The reason for the sharp rise in the short interest may have been in anticipation of insiders selling their stock.

Roku’s shares may continue to see pressure in the coming weeks, should insiders continue to sell their stock, something worth keeping an extremely close watch over.