Institutions Win Big In Autodesk

Posted on April 9th, 2018

Shares of Autodesk, Inc. (ADSK) have rebounded sharply since its near 20 percent decline from November 28 through December 26. Hedge funds and institutions were busy acquiring the stock during that steep sell-off. The purchases in the fourth quarter have paid off in a big way with shares of Autodesk jumping by nearly 20 percent in 2018.

Autodesk has been a core holding in the WhaleWisdom WhaleIndex Portfolio since February 15, 2017. The stock has risen by over 49 percent since being added, and institutions and hedge funds have been steadily increasing their ownership of the software company as well.

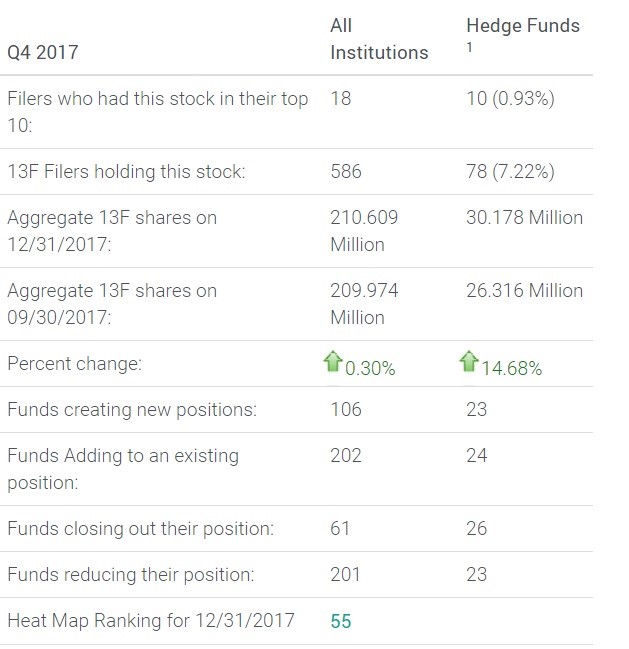

Institutions Adding

During the fourth quarter, 47 institutions created or added to positions in the stock, while 49 institutions reduced or closed out their positions. However, the aggregate number of shares held in the stock increased by nearly 15 percent to 30.18 million shares, up from 26.31 million in the third quarter.

Citadel Advisors, LLC and Viking Global, LP were two of the largest buyers adding over 2.749 million and 1.664 million shares, respectively. However, Wellington Management Group, LLP trimmed its position nearly by roughly 1.9 million shares, reducing its stake by nearly 40 percent.

Bullish Analyst

Analysts are bullish on the stock as well with the forecast calling for earnings growth of over 250 percent in fiscal 2020 to $3.19 per share, from $0.90, while revenue is expected to climb over 27 percent, to $3.179 billion from $2.496 billion. Analysts are looking for Autodesk’s bull run to continue in 2018, with an average price target of nearly $144 per share, 15 percent higher than its current stock price of $125.75. Nearly 78 percent of the 23 analysts that follow the stock have a “buy” or “outperform” rating on the stock, while roughly 22 percent have “hold” or “sell” recombination, according to Ycharts.

Not All Rosy

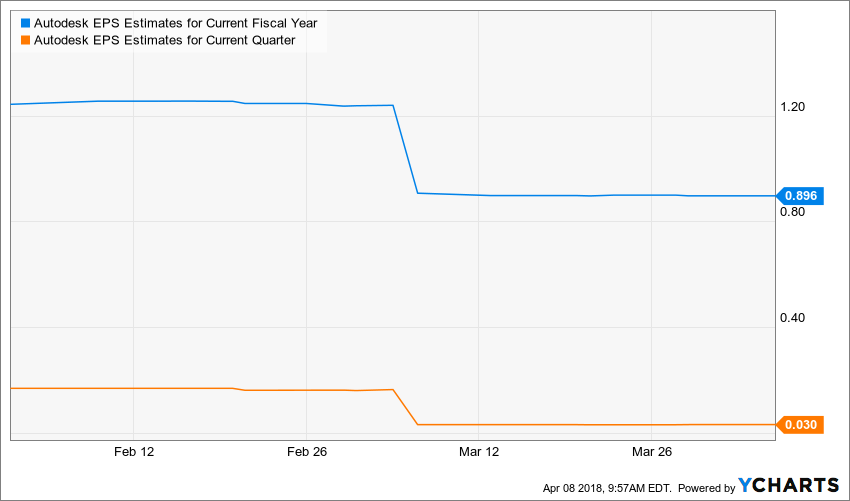

It is not all rosy for Autodesk because those same analysts have also been trimming their outlook of the monstrous earnings growth rate. Over the past 30 days, analysts have been slashing their full-year earnings outlook for fiscal 2019 by nearly 28 percent and trimming revenue estimates by 2 percent. The outlook for first quarter 2019 has also declined, with earnings estimates dropping nearly 82 percent over the past 30 days to $0.03, while revenue has been cut by nearly 4 percent to $562 million when the company next reports results in the middle of May.

With institutions betting that shares of Autodesk would rise in the first quarter of 2018, we might start getting a look at what they think about the company for the balance of the year when first-quarter filings start getting released from now until May 15. We might even know ahead of the next round of quarterly results, and it could be a good indication where shares go for the balance of the year.