Apple’s Historic Rise

Posted on August 24th, 2020

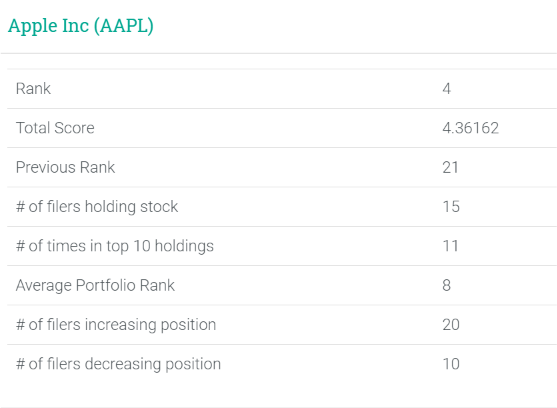

Apple, Inc.’s (AAPL) stock saw substantial growth over the past few months following a brief decline in March when the market, in general, was negatively impacted by the coronavirus pandemic. The multinational technology company moved up on the WhaleWisdom Heatmap to an inspiring ranking of four. Hedge funds were actively buying Apple in the second quarter, as it has consistently outperformed the S&P 500’s performance this year, rising by approximately 69.4% in comparison to the S&P’s gain of about 5.2%.

While Apple initially felt the sting of the economic shutdown in the spring, the negative impact of the pandemic appears to be short-lived, with consumers still quite interested in Apple’s mobile devices, computers, software, and services. It’s likely that even though some consumers may have smaller budgets at this time, Apple has seen positive spending by those influenced by the pandemic’s strong push toward telecommuting, online learning, and keeping home-bound children entertained.

Mixed Actions from Hedge Funds and Institutions

Looking at second-quarter activity by the top hedge funds, Apple saw an increase in its aggregate shares held. Total 13F shares held rose to about 352.8 million from 352.4 million, an increase of approximately 0.1%. Of the hedge funds, 49 created new positions, 161 added to existing ones, 29 closed out their holdings, and 278 reduced their stakes. In slight contrast to hedge funds, institutions were selling. Overall, institutions decreased their aggregate holdings by about 7.6%, to approximately 2.6 billion from 2.8 billion.

Impressive Multi-Year Estimates

Analysts anticipate that earnings per share will continue to rise from 2020 through 2022, with year over year growth ranging from about 6.6% to 19.4%. These significant year-over-year estimated increases would bring earnings to $16.45 per share in 2022, up from an estimate of $12.92 for 2020.

Some Analysts Are Cautious Despite Stock Performance

Despite favorable estimates for the next few years and a market capitalization that has reached a landmark of $2 trillion, many analysts show a reasonably cautious view on Apple’s stock. Bank of America Co.’s analyst, Wamsi Mohan, noted revenue deceleration in China and maintained a price target of $470 with a neutral rating on the shares. Bernstein Investment Research’s analyst, Toni Sacconaghi, believes that Apple is underspending on research and development in comparison to its peers. However, Wedbush Capital’s analyst, Daniel Ives, pointed out that while the pandemic continues to weigh on near-term consumer trends, opportunity lies ahead for Apple as many consumers are eligible to upgrade their mobile phones to the iPhone 12. Ives maintains an Outperform rating on the shares with a price target of $515.

Positive Outlook

Apple has demonstrated impressive upward momentum at a time when so many other businesses have had growth negatively stunted by the pandemic. While investors should apply caution in decision making, there is a good possibility that the pandemic will continue to be a strong motivator for many consumers to spend on Apple’s products. Growth estimates for Apple offer an additional sign of confidence for future performance for this tech company.