Upwork Begins to Rebound as Hedge Funds Move In

Posted on September 28th, 2020

Upwork Global, Inc.’s (UPWK) stock has advanced sharply in 2020 after a rocky start. The provider of online recruitment services was recently added to the WhaleWisdom Whale Index on August 17, 2020. The addition was due to hedge funds that were actively buying the stock in the second quarter. As a result, Upwork has overall outperformed the S&P 500 year-to-date, rising by approximately 56.5% in comparison to the S&P’s gain of about 2.1%.

Upwork is an American freelancing platform that offers jobs spanning many careers, from website developers to accountants. The company appears to be moving beyond the negative impact of the coronavirus pandemic, which brought so many businesses to a temporary halt in the spring. Now Upwork has the potential to capitalize on a shift to a remote workforce, resulting from the pandemic.

Hedge Funds and Institutions Are Buying

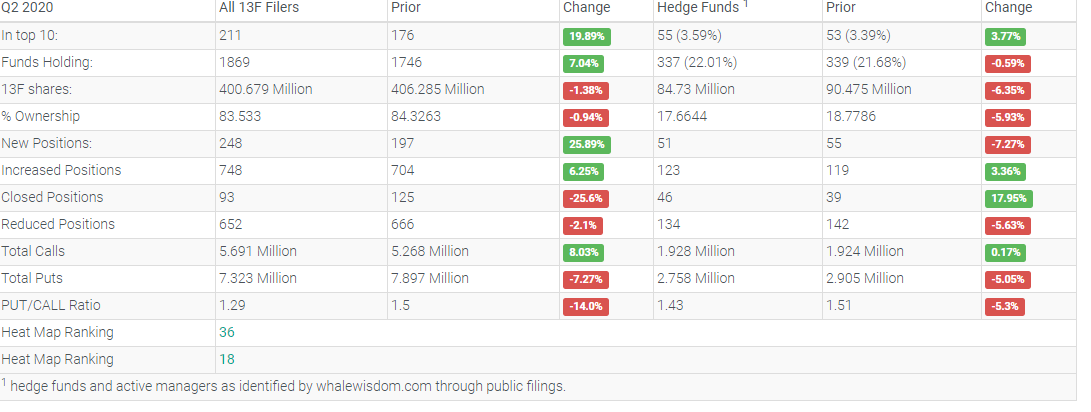

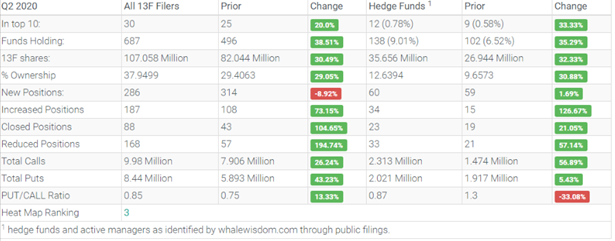

Upwork has hedge fund managers and institutions taking notice. Looking at the second quarter activity by the top hedge funds, the aggregate 13F shares held jumped to about 27 million from 24.7 million, an increase of approximately 9.3%. Of the hedge funds, 23 created new positions, 11 added to an existing holding, 16 exited, and 19 reduced their stakes. Overall, institutions increased their aggregate holdings by about 13.7%, to approximately 71.9 million from 63.3 million.

Projected Losses Despite Revenue Growth

Analysts anticipate that earnings will narrow slightly over the next few years, rising from a loss of $0.32 per share in 2020 to a loss of $0.15 in 2023. However, revenue will see multiple years of growth, rising to $545.5 million in 2023 from $353.85 million in 2020.

Analysts Share Mixed Feelings

While overall, analysts appear to gravitate towards a Buy rating for Upwork, there are some mixed thoughts, especially after second-quarter results and a transition in leadership. Upwork welcomed a new CFO in August and a loss in earnings despite marketplace revenue being up approximately 19%. MKM Partners LLC’s analyst, Rohit Kulkharni, sees potential for Upwork, noting that the company has only begun to capitalize on an economy that’s more open to a workforce of remote and on-demand workers. MKM gives Upwork a Buy rating and a $20 price target. Meanwhile, Citigroup, Inc. downgraded Upwork from a Buy to Neutral rating, giving it a price target of $12.

Optimistic Outlook

The future holds promise for Upwork. The company continues to weather the pandemic and seize new opportunities from changing workforce preferences. Hedge funds and institutions are buying, while many analysts are optimistic on the long-term growth story. That may prove to be a winning formula for a higher stock price in future years.