Booking Begins a Steady Recovery

Posted on July 20th, 2020

Booking Holdings, Inc. (BKNG) has traveled along a rocky path in 2020. However, despite being deeply impacted by the coronavirus pandemic’s whirlwind, the online travel company was added to the WhaleWisdom Whale Index on May 18, though not yet on the WhaleWisdom Heatmap.

Booking owns and operates several travel fare search engines, providing customers with deals on everything from hotel rooms and car rentals to airline tickets. Booking is often known for its namesake, Booking.com, but it operates several other businesses such as Priceline.com and OpenTable.

Hedge Funds Are Buying

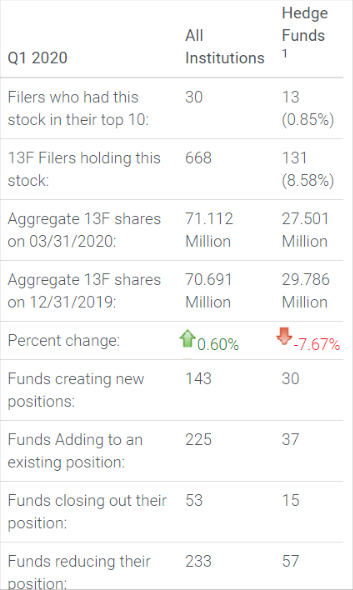

Booking appears to have faced the pandemic’s interference with the hospitality and travel industries head-on and is on track to ride out the storm. Hedge Funds were actively buying the stock in the first quarter, and the aggregate 13F shares held by hedge funds increased to approximately 14.1 million from 13.1 million, an increase of about 8.1%. Overall, for hedge funds, 56 created new positions, 88 added to existing holdings, 61 closed exited, and 96 reduced their position. In contrast, Institutions decreased their aggregate holdings by about 0.6% to 37.6 million from 37.9 million.

Positive Estimates

Analysts expect to see an initial decline in revenue for 2020, but also anticipate a three-year positive trend to follow, beginning with year over year growth of about 66.2% for 2021. These year-over-year estimate increases could bring growth to over $16 billion in revenue and earnings per share at $129.86 by the end of 2023, up considerably from its forecasted value of $14.37 by the end of 2020.

Amidst the Current Clouds, Analysts Predict Sunny Skies Ahead

Morgan Stanley’s analyst, Brian Nowak, has a favorable outlook for Booking’s stock and raised the company’s price target to $1,560 from $1,030. BTIG Investment Banking’s analyst, Jake Fuller, cited a consensus calling for a V-shaped recovery and gave Booking a Neutral rating. Wedbush Securities’ analyst, James Hardiman, also has a Neutral rating on Booking and predicts that the company will recover into a stronger position over the next few years.

Optimism Beyond 2020

While 2020 has had its share of tough months for Booking, analysts are optimistic about the future. Customer demand for travel and restaurant dining will return, and while the pace may be slow, it seems inevitable that the use of Bookings’ various reservation tools will occur. Booking has gained some upward traction in recent months and holds promise beyond 2020 for patient investors.