Will Hedge Funds Be Dumping Alibaba After Results?

Posted on May 6th, 2019

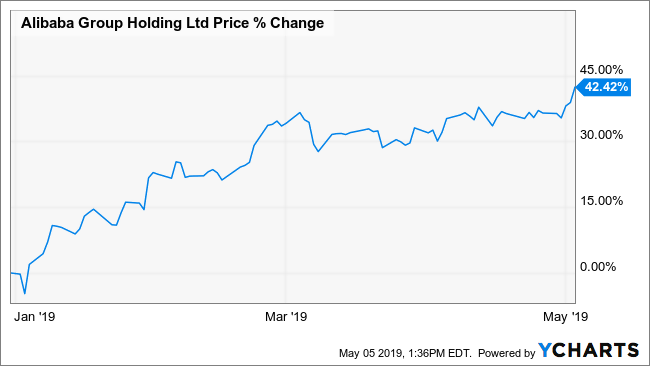

Alibaba Group Holding Ltd.’s (BABA) stock has soared in 2019, rising a stunning 42%. The strong stock performance followed a horrid fourth quarter when the shares plunged on trade war worries and fears of slowing global growth. However, the tides have turned and it seems that investors are now aggressively buying the stock given its sharp rise, ahead of the company’s fiscal fourth quarter results on May 15.

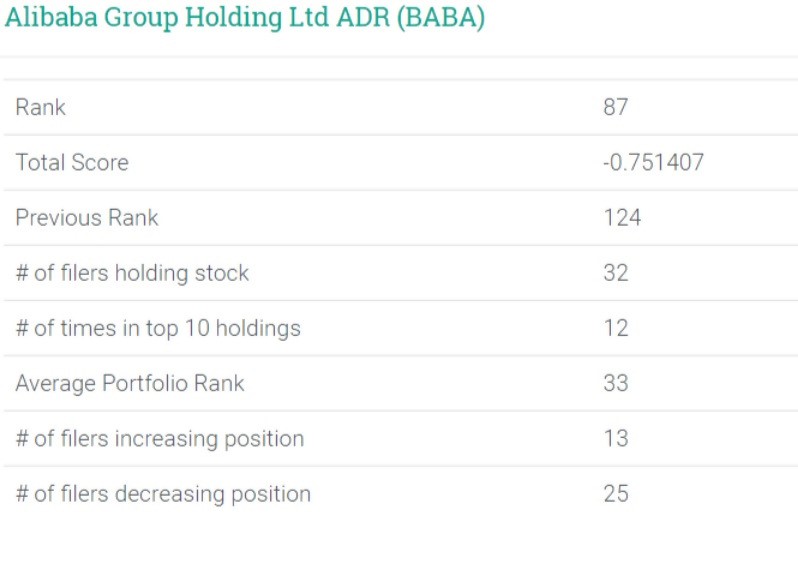

Despite the horrible fourth quarter stock performance, the shares landed on the WhaleWisdom heat map at 87, up from its previous position of 124. The heatmap tracks the top 150 hedge funds using the most recent WhaleScore calculation.

Scooping Up Shares

Fourth quarter holdings revealed that 32 of the 150 hedge funds tracked for the heat map held shares of Alibaba, while 12 of the funds held the stock among their top-10 holdings. Additionally, 13 funds increased positions and 25 funds decreased holdings. However, what’s more interesting is that overall total institutions were buying the stock, with the number of total shares rising by 4% to 1.03 billion.

Betting on Better Results

With the earnings just a couple of weeks away, the stock has been on the rise. Since April 30, the shares have increased by over 5%. It follows a period between the beginning of March and the end of April that saw the stock rise less than 1%. Also, helping to fuel that rise is renewed hope that the US/China trade war may soon come to an end. The stock has often been used as a proxy for the trade war.

Opportunity Is There

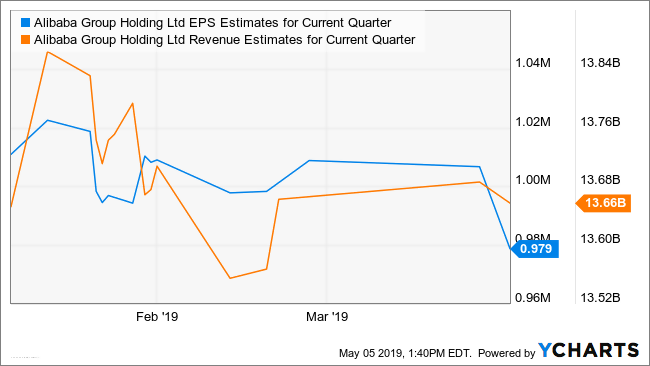

Analysts currently estimate that revenue increased by more than 40% in the fiscal fourth quarter to $13.7 billion. However, earnings are expected to have grown by around 9% to $0.98. The company has been investing back into the business in recent quarters, causing margins to contract, which has produced weaker earnings. It does set up an opportunity for the company to top results on the bottom line. It may be another reason why the stock has suddenly started to rise recently.

If it is the case that earnings are better than expected, it may result in the stock rising to even higher prices. It could cause a melt-up scenario, as investors that may have missed the first quarter rally begin to pile into the name. The big question will be what the investors that bought the stock at lower levels will be doing? Profit taking could undoubtedly be a genuine possibility.