Qualcomm Was A Top 10 Stock In 1Q Among Investors

Posted on May 21st, 2018

Qualcomm Inc. (QCOM) has been in the news a lot lately, but not for good reasons. In late 2017 Qualcomm was targeted by Broadcom Ltd. (AVGO) in a takeover attempt, which was later blocked by the US Government. Lately, its stock has become a barometer tied to the trade tensions between the US and China. Qualcomm is still waiting to get a final approval from regulators in China for its $44 billion acquisition of NXP Semiconductors NV (NXPI).

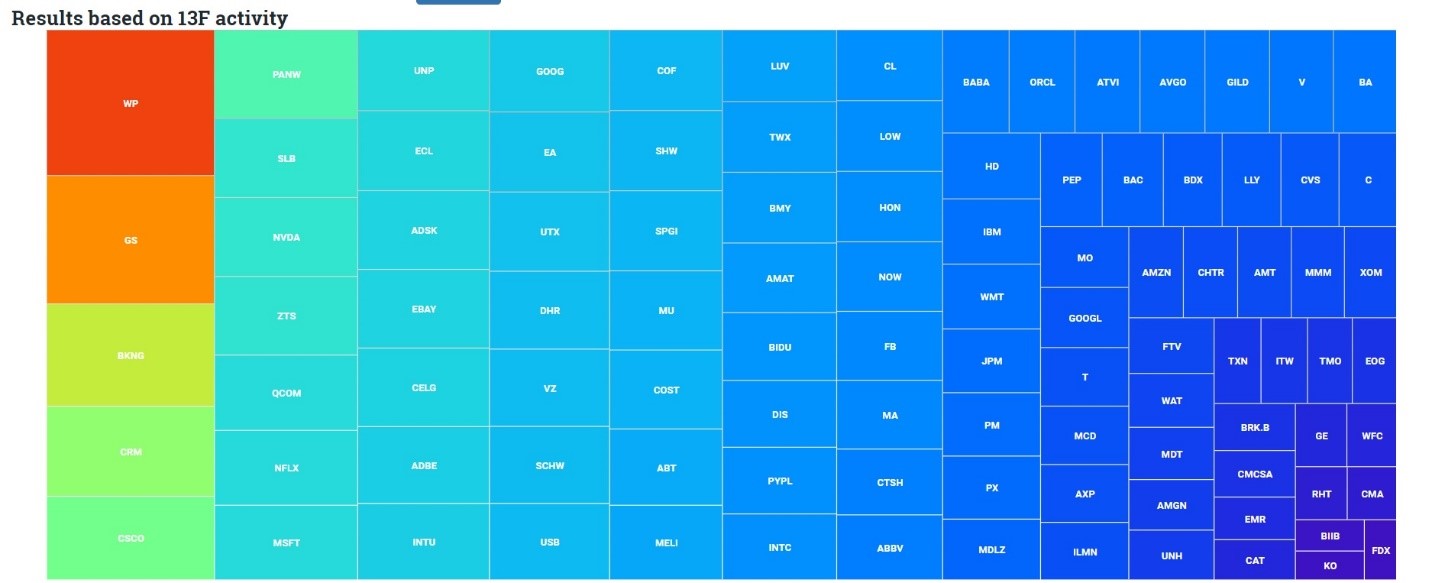

All the negative headlines have not deterred investors, in fact, the stock was among the top 10 on the WhaleWisdom 13F Heatmap. The high ranking makes it one of the hottest stocks amongst institutional investors during the first-quarter.

Rotation Among Holders

There appeared to be a rotation among the shareholder base, with only a minor change in the aggregate 13F shares. At the end of the first quarter, the aggregate 13F shares fell by 1.87 percent to 1.14 billion from 1.161 billion in the fourth quarter. In total 106 institutions created new positions in the stock, while 514 added to holdings. Meanwhile, 150 institutions exited the stock, while 651 reduced their stakes.

Dim Prospects

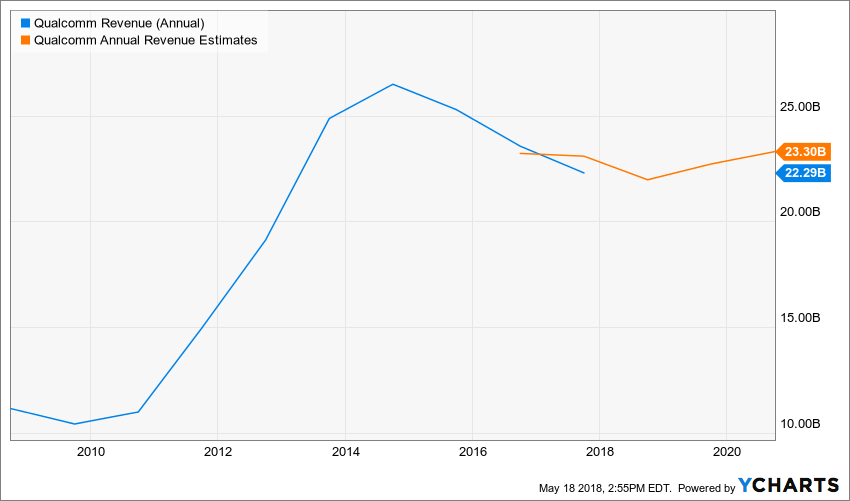

The outlook for Qualcomm doesn’t look particularly attractive over the short-term, which has to make one wonder why investors would be so hot on the stock during the quarter. Analysts are forecasting earnings to fall by over 23 percent to $3.29 per share, while revenue is expected to drop by 5.5 percent to $21.97 billion, its lowest revenue reading since 2012. Revenue peaked at $26.5 billion in 2014, and could decline by 17 percent should analyst estimates prove to be correct.

Not Even a Bargain

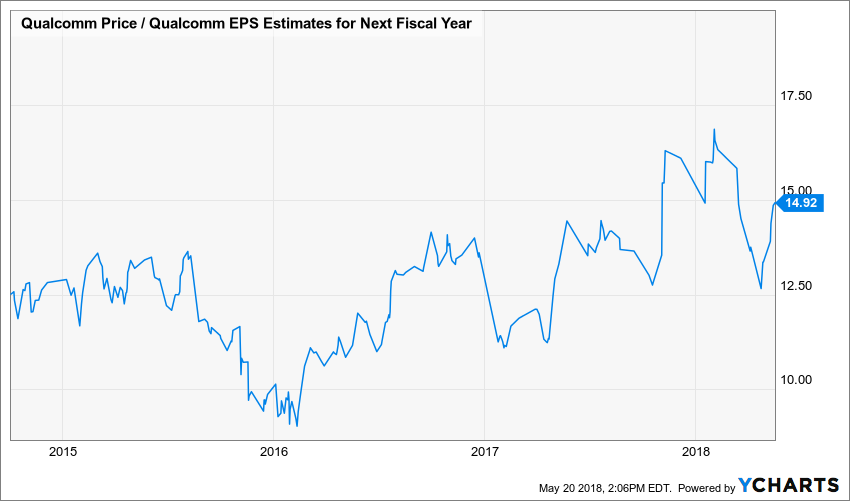

Shares of the stock aren’t even cheap trading at almost 15 times 2019 earnings estimates of $3.81 per share. That one-year forward earnings multiple is on the upper end of its historical PE ratio over the past three years.

Analysts Lukewarm

Even the analysts appear to have questions on Qualcomm, with a heavily reduced average analysts price target of $63, about 11 percent higher than the stocks current price around $57.70. However, that average is down by about 12 percent from roughly $72 in the middle of March. Of the 25 analysts covering the stock, only 48 percent rate shares a “buy” or “outperform,” while 44 percent have a “hold” rating, not an overwhelmingly bullish endorsement.

A Bet on the Future

It may simply be a bet on the prospects for Qualcomm should it be able to finally close its deal of NXP Semiconductors, after waiting for over one-and-a-half years. The combined company would have a much more diversified portfolio and be better positioned for future growth in autonomous driving, artificial intelligence, near field communication, and the rollout of the next generation in wireless technology, 5G. Perhaps with shares down by nearly 16 percent so far in 2018, some investors viewed the pullback as an opportunity to pick up shares.

We will never know for sure, what the motivation for investors were during the first quarter, but it seems clear it must be for the future of the business because the current prospect looks pretty dismal.