PayPal Continues to Lose Ground As Institutions Sell

Posted on February 14th, 2022

PayPal Holdings, Inc. (PYPL) stock has underperformed the S&P 500, declining to roughly -3.0% compared to the S&P 500’s gain of around 31.6% over the past 2-years. Hedge funds were actively buying PayPal’s shares, though, with the slowdown in performance, the stock slid on the WhaleWisdom Index to a ranking of 34 from 23.

PayPal operates an electronic payments system to facilitate convenient and secure e-commerce to two customer segments: consumers and merchants. Consumers can use the digital platform to shop and transfer money to merchants, family, and friends. Merchants can set up PayPal business accounts to receive payments for their goods and services. Customers may use PayPal’s website, mobile application (app), or mobile payment subsidiaries Venmo and Xoom. PayPal generates much of its revenue through transaction fees and service subscriptions. PayPal offers financial services such as debit cards, credit cards, loans, shipping services and allows customers to buy, sell, or hold cryptocurrency.

The company has faced market volatility and challenges such as inflation’s impact on consumer spending, pandemic-related supply chain issues reducing transaction volume, and the cleanup of millions of illegitimate and inactive accounts set up by those taking advantage of rewards programs. Additionally, after an almost two-decade-long partnership with the online marketplace eBay, PayPal faced reduced transaction activity when eBay began paying its sellers directly rather than through PayPal, though still allowing shoppers to pay through PayPal.

Hedge Funds and Institutions Tweak Portfolios

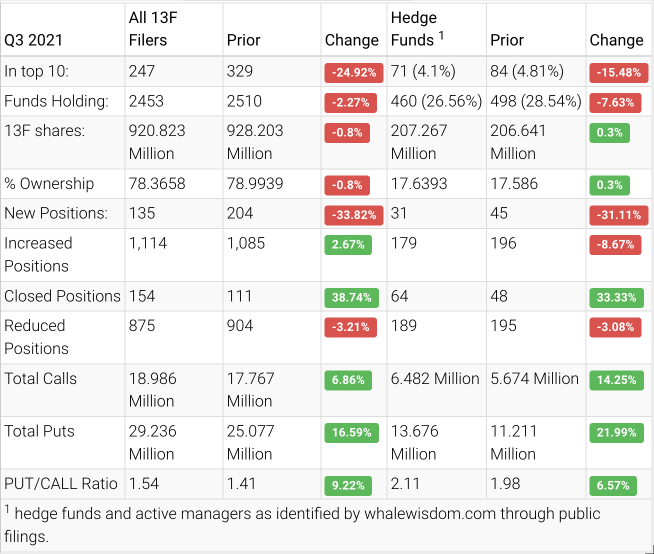

The aggregate 13F shares held by hedge funds increased to approximately 207.3 million from 206.6 million, a positive change of about 0.3%. Overall, 31 hedge funds created new positions, 179 added to existing holdings, 64 exited, and 189 reduced their stakes. Despite, hedge funds adding to positions, institutions were selling and lowered their holdings by about 0.8% to 78.4 million from 79.0 million.

Positive Multi-year Figures

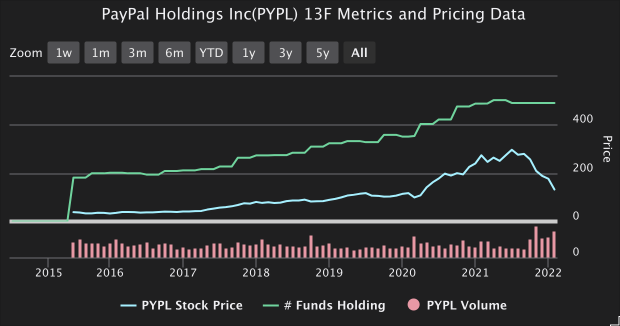

Analysts expect to see earnings rise to $4.67 per share by December 2022 and $5.87 by December 2023. Revenue estimates offer encouragement, with predictions of approximately $29.4 billion for December 2022 and about $35.3 billion by December 2023. The 13F metrics between 2015 and 2022 reflect PayPal’s recently fluctuating stock price, while the trend for portfolio holdings demonstrated steady improvement before leveling off and declining in recent months.

Analysts Lower Price Targets

While PayPal is still a key player in e-commerce, analysts have been lowering price targets. Mizuho Financial Group analyst Dan Dolev lowered the firm’s price target on PayPal to $175 from $200 while maintaining a Buy rating. Dolev also shared favorable observations about the stock, including that its payment value is accelerating, and engagement is advancing, despite eBay’s transaction processing changes. Analyst Harshita Rawat of AllianceBernstein Holding LP lowered the firm’s price target on PayPal to $140 from $180 and kept a Market Perform rating on shares. Needham & Co. analyst Christopher Brendler shared his optimism for PayPal, calling it a “long-term winner” despite recent changes with eBay. Brendler kept a Buy rating on PayPal’s shares and lowered its firm’s price target to $166 from $275. Barclays analyst Ramsey El-Assal kept an Overweight rating on PayPal’s shares following fourth-quarter results while reducing the firm’s price target to $200 from $250.

Potential Beyond 2022

Growth has slowed, but PayPal still has earnings potential. Its strong track record and future estimates may not be enough to bring an influx of new investors at this time, but the e-commerce giant still has appeal, and current shareholders may want to hold their shares. It’s certainly a stock to watch.