Adobe’s Slowed Growth Causes Investors To Sell

Posted on October 3rd, 2022

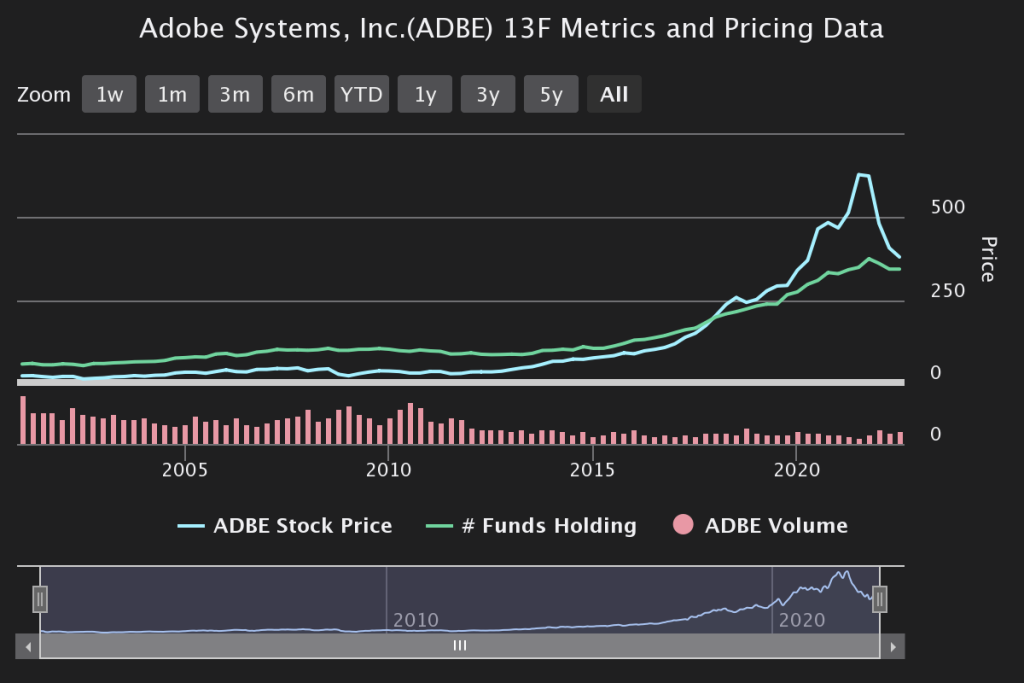

Adobe, Inc. (ADBE) continues to shadow the S&P 500 as it navigates a volatile market. The first nine months of 2022 have been challenging for many companies and investors. Adobe underperformed the S&P, seeing negative growth of approximately 51% as of September 29, 2022, while the S&P declined about 15% over the past year. Hedge funds were selling the stock in the second quarter, though the stock rose on the WhaleWisdom Heatmap to a rank of six from eighteen.

Adobe is a digital media software company offering its products and services worldwide. Originally known as Adobe Systems, Inc., it operates through a segmented business model that includes Digital Media, Digital Experience, Marketing, Print, and Publishing. One of Adobe’s flagship products is Creative Cloud, a subscription service offering access to its products. The company is also well known for its Photoshop image editing software, Acrobat Reader, and the Portable Document Format (PDF). Adobe’s target customers span from enterprises to individual customers.

The software company announced in mid-September that it would purchase Figma for about $20 billion in cash and shares. Figma is a collaborative web application for interface design that is popular with designers and developers. While the business venture may strengthen creative collaboration, the acquisition announcement contributed to a dip in Adobe’s stock performance in recent weeks.

Hedge Funds and Institutions Sell

Hedge Funds adjusted their portfolios in the second quarter, and the aggregate 13F shares held decreased to approximately $82.1 million from $83.4 million, a reduction of about 1.6%. Overall, 35 hedge funds created new positions, 173 added to an existing one, 44 closed out exited, and 147 reduced their stakes. Institutions lowered their holdings by about 1.6% to $374.2 million.

Encouraging Multi-year Estimates

Analysts predict earnings per share will rise in the coming years, increasing to $15.57 by November 2023, up from an expected $13.62 for November 2022. The company’s performance is anticipated to bring revenue to roughly $19.9 billion by early 2023, up from an estimated $17.6 billion in 2022. While Adobe’s stock has declined in recent months, funds held have stayed on a fairly consistent upward trend.

Analysts Respond to Acquisition News

Analyst Michael Turrin of Wells Fargo Securities lowered his firm’s rating on the stock to Equal-weight following news of Adobe’s acquisition of Figma. The pricy purchase should be completed in 2023, and many analysts are concerned about slower interim growth. Edward Jones’ analyst, Logan Purk, also downgraded Adobe, despite seeing the long-term merits of the investment. Evercore ISI’s analyst, Kirk Materne, shared enthusiasm about the acquisition of Figma and gave Adobe an Outperform rating.

Cause for Optimism Beyond 2022

While Adobe’s growth has slowed, earnings and revenue estimates through 2023 are encouraging. Analysts see the strategic, long-term potential of Adobe’s recent acquisition.

Investors may be hesitant; however, Adobe has the potential to rise again within the coming years.