4 Biotech Stocks The Bakers Brothers Bought In The Fourth Quarter

Posted on March 5th, 2018

Baker Brothers Advisors where hard at work during the fourth quarter of 2017, adding to or upping their stakes in multiple companies. However, when reviewing the recent holdings, four companies stood out, BeiGene (BGNE), Madrigal Pharmaceuticals (MDGL), Sage Therapeutics (SAGE), and Nektar Therapeutics (NKTR).

The four stocks noted, are both interesting due to the timing, while the dollar amounts put to work were stunning. However, the firm is known for finding small biotech companies, that can sometimes turn into giants, such as Incyte (INCY) and Seattle Genetics (SGEN), their two largest holdings, account for roughly $5.8 billion.

BeiGene

According to the latest 13F the Bakers own approximately 3.85 million shares of BeiGene. Based on the current price of approximately $150 per share, it represents a market value of roughly $578 million, which easily makes it a top 10 holding. BeiGene focuses on immuno-oncology treatment for cancer, and the stock has already surged by nearly 52 percent in 2018. The company recently received approval from the China Food and Drug Administration for REVLIMID, in a licensing deal with Celgene (CELG). According to Ycharts analyst are looking the company to grow sales to $207 million by the year 2020.

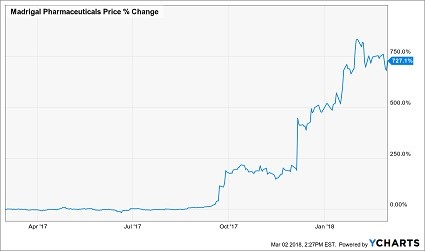

Madrigal

The Bakers also recently added Madrigal Pharmaceuticals to its portfolio in the fourth quarter and own approximately 615,684 shares. Based on the stock’s price of roughly $131 per share, the market value stands at roughly $80.6 million, making it a mid-tier holding in the portfolio. The stock is up an amazing 725 percent over the past 52-weeks. Shares soared in early December after the company announced positive top-line results for it phase 2 trial for lead drug candidate MGL-3196, in patients with biopsy-confirmed nonalcoholic steatohepatitis.

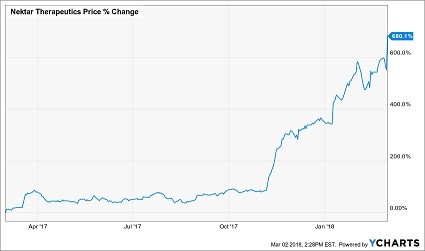

Nektar

Nektar Therapeutics was also a new position in the fourth quarter, with the Baker’s adding 171,934 shares. The stock currently trades at $103, giving the holding a value of only $17.7 million, and making it one of the firm’s smaller holdings. However, the timing is what is the most striking because shares have already surged by nearly 700 percent over the past 52-weeks. The stock rocketed higher in mid-November on pre-clinical data showing positive results for its immune-oncology drug NKTR-214, in combination with a PD-1 inhibitor.

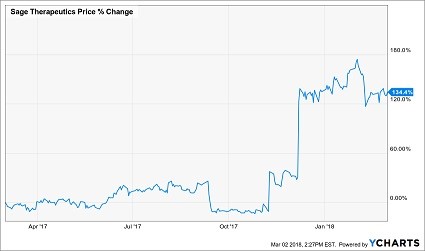

Sage

Sage Therapeutics shares have also surged over the past 52-week by over 130 percent but are nearly unchanged in 2018. The Bakers now own approximately 616,514 shares of Sage and based on its current price of roughly $164, gives the position a market value of about $101 million. The Baker’s added about 200,000 shares of Sage during the quarter from their third-quarter filing of roughly 405,000. It makes the addition worth noting given the sharp run-up in the stock at the end of the year. Sage delivered positive top-line results for SAGE -217 in a phase 2 trial for the treatment of major depressive disorder.

The four stocks have already had big runs and whether the Bakers were early or late may not matter. The only thing may matter is that the Baker’s saw each having value at the time they entered the position, and that likely means they looking for shares to continue to rise.